There was a time when lenders avoided certain types of receivables such as progress and percentage of completion billings. However in today’s world this no longer seems to be the case, we frequently see revolving lines of credit that are secured by these types of receivables when performing field exams.

Before you get into the mundane details of the post below take a minute to check out the Disney video, its pretty neat to see history being made. I’m sure there was a lot of percentage of completion and progress billings taking place during this project! About three minutes into the video, a time lapse video of Main street being built is shown.

And now on the the more serious stuff!

This post is not intended to give the reader a road map as to how to navigate through the legalities involved with perfecting these receivables, nor is it intended to explain the accounting principles and methods used to account for these types of transactions. It is assumed that the financing has already been successfully completed and that the Company that generates these receivables is already a borrower. The purpose of this post is to present a way of handling AR that is created through a percentage of completion or progress billing.

Before we delve into the specific calculations, it might be a good idea to review what is meant by a percentage of completion billing and a progress billing and why these items have historically been the ugly step child of accounts receivable financing.

Percentage of Completion

Percentage of completion is a form of billing for services rendered employed by Companies that enter into long term contracts. This method of revenue recognition is popular among construction companies and other companies that perform services over a long period of time. The amount billed is based on the perceived “percentage of completion.” The is often determined by collaboration between the general contractor, the project manager and perhaps the property owner. If a project is deemed to be 30% complete, 30% of the contract price will be billed. Many factors can come into play that can impact the amount that is invoiced, these include:

- the desire of contractors performing the service to collect as much of the contract price as early as possible,

- the availability of funds from property owners and/or general contractors

- the desire of general contractors and property owners to delay payment as long as possible to ensure that the project is completed to specifications.

- The actual amount of work completed or yet to be completed

Typically in a percentage of completion type of billing arrangement, invoices are generated based on a predetermined schedule such as once per month, quarterly or bi-monthly.

Progress Billings

Progress billings differ from percentage of completion billings, in that the amounts and timing of the invoices are based on milestones. Milestones can be a certain event, a point in time or they may even be a percentage of completion. Contracts will call for a percentage of the contract price to be invoiced based on the milestone being complete. Some examples of milestones are:

- 25% of the contract price is due upon signing

- 10% due upon delivery of machinery or equipment, or supplies

- 50% due upon installation of machinery or equipment, or completion of a certain task such as the foundation or roof of a building.

- 25% due upon signing, 25% due when project is 60% complete, 40% due when project is complete and final 10% due one year after completion

Lender’s Concerns

There are many risks associated with AR resulting from long term contracts for lenders. Probably the most pressing one is collection risk. One can see from the descriptions above that these types of receivables pose several threats to the collection of the AR should the lender be forced to liquidate the collateral. Is the amount billed appropriate? Can an invoice for 25% of a project be collected if only the contract has been signed and nothing else has been completed? Generally, the collection of amounts due in excess of the services performed is going to be dicey at best. The best case scenario will probably require the lender to keep the Company or project going until at least the services completed match the amounts billed. Obviously, this will impact the net amount collected and how successful the lender is in liquidating the collateral and recovering its investment. Fortunately a lender can help protect itself from over advancing on these types of receivables by carefully analyzing the amounts billed, the costs incurred and the open AR amount for the projects in process or construction in progress.

The Matching Principle

Although a deep understanding of the accounting principles and methods used for long term projects are not needed to analyze the AR created from those long term contracts in an ABL arrangement, it is important to understand why a company is required to employ the matching principle and how the matching principle can be used to better manage the risk associated with these types of AR.

GAAP calls for the recognition of revenue to be matched to the corresponding costs incurred. The matching principle basically calls for companies to the best of their ability to match revenue recognized to the costs incurred for long term contracts. The purpose of the matching principle is to smooth out the Company’s performance and eliminate artificial peaks and valleys in profits and revenues that could be caused by contractual billing terms and or uneven cost requirements of a contract.

For example, a construction contract that has a projected 10% gross profit built in may call for a 25% deposit due upon signing, 25% due when the project is half complete, 25% due upon completion of the project and 25% due three months after the project is completed (to ensure that all items/problems are resolved). Without the Percentage of Completion method of revenue recognition this contract would cause the Company to show a huge profits when the contract is signed, losses during the construction phase and another large profit at the end of the contract. Lets assume the following:

- the value of the contract is $1,000,000.

- The cost to complete the contract is $900,000

- Costs are incurred evenly throughout the project.

- Contract is signed in the first quarter, 33.3% complete in the 2nd quarter and 66.7% complete in the 3rd quarter and 100.0% in the 4th Quarter.

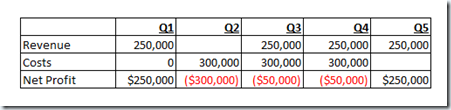

Without the matching principle the company would have the following P&L’s

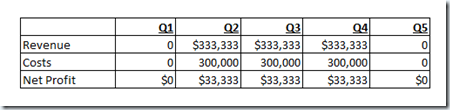

The matching principle calls for the company to recognize the revenue (and profit) as costs are incurred:

As can be seen above the matching principle eliminates much of the variance in the net profit and operating results of the Company. The impact of employing this principle helps to smooth a company’s results and eliminate the wide swings. Presumably this helps users of the company’s financial information to come to better investment and financing decisions.

Of course the problem with the above for lenders is that is not how the contract is written, nor how the transactions occur. A lender can incorporate the data needed to employ the matching principle in its risk management of percentage of completion accounts receivable or progress billings. In order to accommodate the matching principle, a Company will need to create several contra accounts. These include unearned revenue, billings in excess of costs, costs in excess of billings and construction (or project, job or some other label) in progress. The contra accounts are all balance sheet accounts.

In order to properly account for the contracts and also to follow the “matching principle,” most companies will have schedules that show contract values, amounts billed, total expected costs (and profits) and costs incurred to date. Usually all this information can be found in one schedule, occasionally it may be separated between revenue items and expenses.

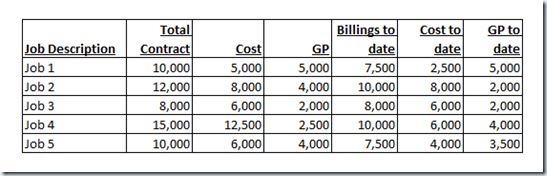

Whatever the method is used by the client to account for the various items needed in a percentage of completion or progress billing system, the examiner is going to need to obtain the following data points for each long term project included in the accounts receivable:

- Total value of the contract

- Amount billed to date

- Total expected cost (or gross profit, so that costs can be determined)

- Total costs incurred to date

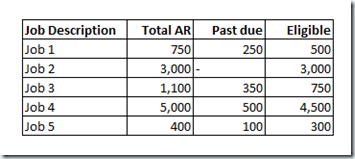

Lets assume that we are at a company that has AR due from five long term projects:

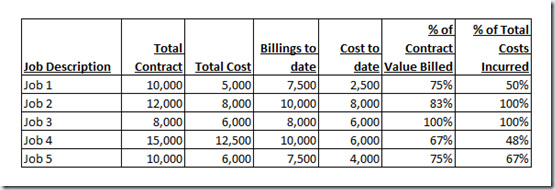

Lets also assume that the five projects are all in process and the Company has a job cost system that shows the following data points:

For our purposes the gross profit amounts are immaterial and can be ignored.

What is important is determining the amount of the open AR that is collectible based upon the work actually completed to date. As noted above, the amount invoiced may have very little correlation to the amount of work performed. In addition, the total AR for each project may cover several invoices with some paid and some not; therefore, it is necessary to analyze each project at the project level and not the invoice level.

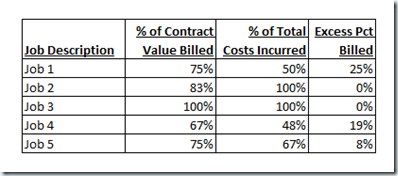

From the data above we can determine the percentage billed and the percentage of costs incurred to date by simply dividing the amounts billed by the contract value and the costs incurred by the total expected costs:

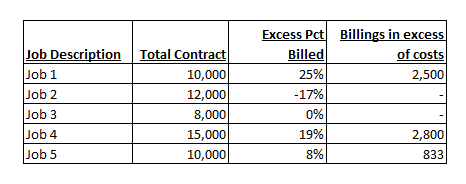

From the above table we can determine the jobs where the percent billed is in excess of the percentage of costs incurred by simply subtracting the percentage of costs incurred from the percent billed. If the result is a positive percentage, then the there is “billing in excess of costs” that should potentially be reserved for, if the result is negative a zero is shown as there would not be an excess amount billed when comparing the billings to the costs incurred:

By multiplying the contract amount by the excess percent billed, we can determine the potential amount of excess billings that may need to be reserved for:

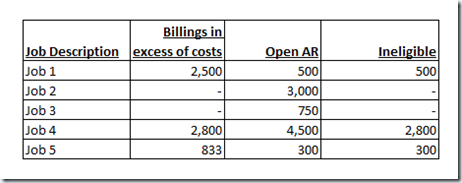

The amounts in the billings in excess of costs column can now be compared to the open AR amount for each job and the lesser of the open eligible AR and the billings in excess of costs can be made ineligible:

So, for the $9,050 in eligible AR analyzed, a total of $3,600 or 40% should be reserved for. If the above five jobs represented a sample of the total long term contract AR balance, then the examiner may want to extrapolate the results and reserve for 40% of eligible AR as opposed to a specific dollar amount.

That’s it for now. Please feel free to leave a comment or question. If you would rather contact me directly you can email us at [email protected]

For more information on ECG Collateral Services, please visit our website at www.ecgcollateralservices.com

For samples of reports prepared by ECG please visit http://www.ecgcollateralservices.com/reports